How Healthy is Your Company Culture?

Want to uncover hidden opportunities to improve your workplace culture and engagement? Take this quick quiz to assess your current strengths and discover areas for improvement.

HORNE Ranked Among Top 50 Construction Accounting Firms™ by Construction Executive

HORNE, a professional services firm, has recently been ranked number 21 on Construction Executive’s 2025 list of the Top 50 Construction Accounting Firms™ [will hyperlink once Construction Executive posts their release Aug. 6], marking the firm’s seventh consecutive year on the prestigious list.

The Labor Law Shifts Every Contractor Should Know

Over the past 18 months, a wave of labor law changes has reshaped how general contractors and subcontractors operate, especially in commercial and public infrastructure projects. These shifts carry real implications for workforce strategy, project costs, and legal exposure.

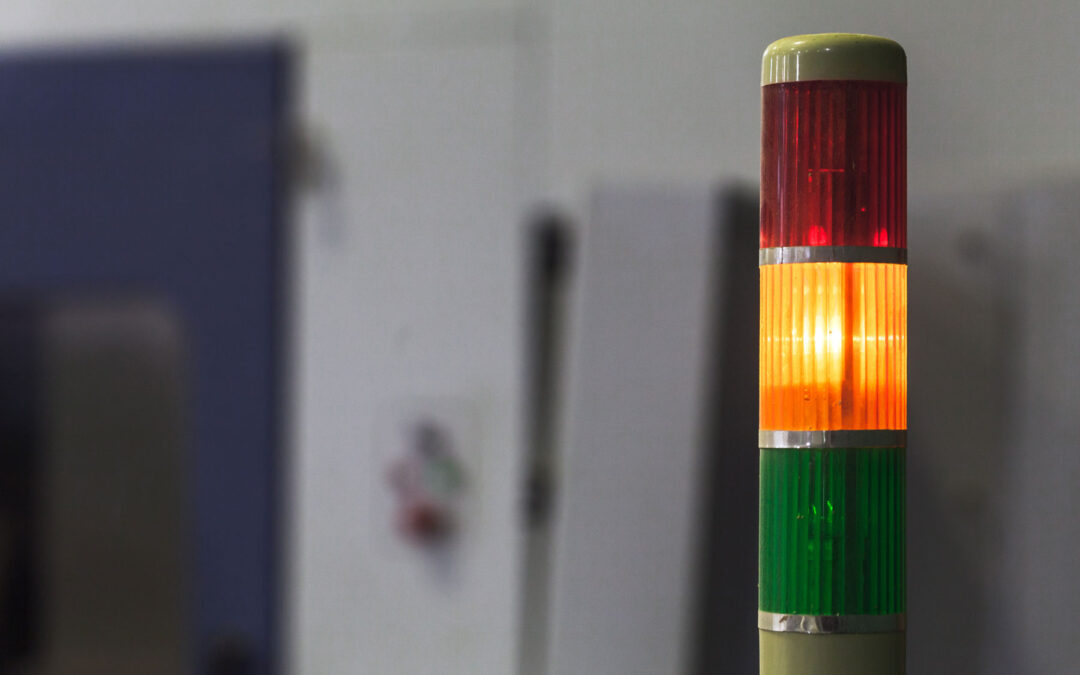

Plan Now or Pay Later: Early Warning Signs for Contractors

Strategic planning isn’t just about reacting faster. It’s about seeing what’s coming and making moves before the impact hits. It’s what separates anticipatory companies from those constantly putting out fires.

Strong Leader vs. Ineffective Leader Framework

How effective is your leadership? This framework outlines the key traits that separate strong leaders from ineffective ones, helping construction professionals assess and strengthen their leadership approach.

Keep It Simple: Technology Implementation Without Complication

Adopting technology in your construction business doesn’t have to be a massive overhaul. Small, intentional steps can lead to significant improvements in productivity and profitability.

Use Per Diem Strategically: Win Jobs, Attract Talent, and Protect Profit

Travel means hassle. From hotel costs and meal expenses to unpredictable expenses, nobody wants to dip into their earnings to fulfill their responsibilities.

That’s where per diem becomes a powerful tool to cover costs and attract top talent, win more bids, and protect your profitability.

Understanding Nexus: Potential Tax Implications of Working Across State Lines

Expanding your contracting business into new states can open exciting growth opportunities, but it can also bring unexpected tax obligations.

Medicaid is Not a Program. It is Many Programs.

The House of Medicaid has many rooms. The Congressional Budget Office (CBO) projects that the federal government will spend $8.579 trillion on Medicaid in the ten-year period 2025-2035. It is no surprise, therefore, that Medicaid has drawn the attention of Congress as it embarks on its journey of producing a 10-year budget reconciliation act.

Medicaid Work Requirements: States Need Flexibility to Create A Bridge Across the “Benefit Cliff”

In the long road to a Budget Reconciliation Act, the House Concurrent Resolution instructs the Committee on Energy and Commerce to “submit changes in laws within its jurisdiction to reduce the deficit by not less than $880,000,000,000 for the period of fiscal years 2025 through 2034.” It is expected changes to Medicaid will produce most, if not all, of these savings. Healthcare is delivered locally. Every House member will want to know how changes impact his/her constituents and district.

Good Culture vs. Bad Culture in the Construction Industry

Culture in construction isn’t just about policies or slogans—it’s about how people show up on the job every day. A good culture means leaders are present, crews feel valued, and trust runs deep. It’s the difference between a team that looks out for each other and one that’s just punching the clock.

Smart Construction: How Robotic Process Automation is Transforming the Industry

The construction industry is experiencing a digital revolution, and Robotic Process Automation (RPA) is at the forefront of this transformation. Once seen as a tool reserved for tech-driven sectors, RPA is now reshaping how construction firms operate, helping them streamline processes, improve accuracy, and cut costs.

Planning for Retirement: How Inflation Impacts Your Financial Future

Inflation is a major concern for retirees, but it’s just one of many financial factors to consider when planning for retirement. Unlike during your working years—when salaries and bonuses may increase with inflation—retirees must rely on savings, investments, and business assets to maintain their lifestyle.

Construction Industry Wrap-Up: 2024 Challenges & 2025 Outlook

As 2024 ends, the construction industry reflects on a year marked by challenges, resilience, and innovation. Looking ahead to 2025, strong leadership and workforce development will be critical for success.

Successfully Navigating Family Business Transitions in Construction

For many construction companies, the foundation of success is family legacy. These businesses, which have often passed down through generations, hold deep-rooted values and industry expertise that set them apart. However, a family-owned construction company that moves from one generation to the next presents unique challenges and opportunities.

Navigating Change: What DBE Contractors Need to Know

The Disadvantaged Business Enterprise (DBE) program is facing significant shifts, making it critical for DBE contractors—especially those in construction—to stay informed and prepared.

(Almost) Everything You Want to Know About Budget Reconciliation

One of the most important pieces of legislation will be to finalize a Budget Reconciliation Act guiding federal spending for the next 10 years. The impact will reverberate with nearly all Americans and businesses in some way, whether through taxes, government benefits or economic conditions.

Proposed Trump Tax Plans vs. Current Tax Laws

The following summary highlights key differences in the Trump and Biden tax plans. All information has been gathered based solely upon verbal or social media communications directly from the candidates or their respective campaigns.

Construction Quarterly Economic Report

CICPAC, in collaboration with economist Dr. Chris Kuehl and Armada CI, has launched a quarterly economic report that specifically targets the construction sector.

From Baby Boomers to Gen Z: Can they actually work well together?

In today’s evolving workplaces, it’s common to see baby boomers to gen z working together in the same company. How can different generations work together with different value systems, approaches to work-life balance and skill sets?

A deeper look at the generations

The workplace is no stranger to diversity, including race, religion and culture. But in the last few years, there has been a significant increase in the diversity and differences in generations.

4 ways to build bridges with multiple generations in the workplace

Those in management positions or roles of influence should learn the best ways to connect and manage each generation in a way that encourages a strong sense of community.

Construction Tax Planning Opportunities

One of the most comprehensive changes included in the TCJA is the changes in tax accounting methods available for contractors.

Juneteenth 2022

Not only is Juneteenth a federal holiday, but this is the first year we observed it as a firm holiday. As we reflect on the meaning of this day in history, let’s also celebrate the freedom and positive change made possible for us all.

We are HORNE Video

At HORNE we believe our journey is meant to make a difference in the lives of those we serve and everyone we encounter, both inspiring and elevating. We are strengthened by living our core values together. We honor God and personal faith. We are committed to serving our families. And because we‘re thankful for all we’ve been given, we approach each opportunity with gratitude. Watch our “We are HORNE” video to find out more about what it means to work at HORNE.

HORNE Named Top Firm in Organic Growth by INSIDE Public Accounting

INSIDE Public Accounting has ranked HORNE the fastest-growing firm in the U.S. for 2021 based on organic growth.

HORNE Earns Multiple Rankings on Accounting Today’s Top 100 Accounting Firms of 2021

HORNE is honored and excited to be recognized by Accounting Today as the No. 2 fastest growing accounting firm in the country and No. 35 overall on its annual list of Top 100 Accounting Firms.

HORNE Tops $1 Billion in Rental Assistance to Residents in 5 States

Since the emergency rental assistance program began, HORNE has received approximately 533,000 applications totaling more than $3.6 billion. So far, HORNE has disbursed over $1 billion to 169,000 applicants.

Same Day Pay: The Pros and Cons for Employees and Employers

Getting paid wages from the same day you work? It may sound like something from the future but it’s already here, and it’s a trend that isn’t going away.