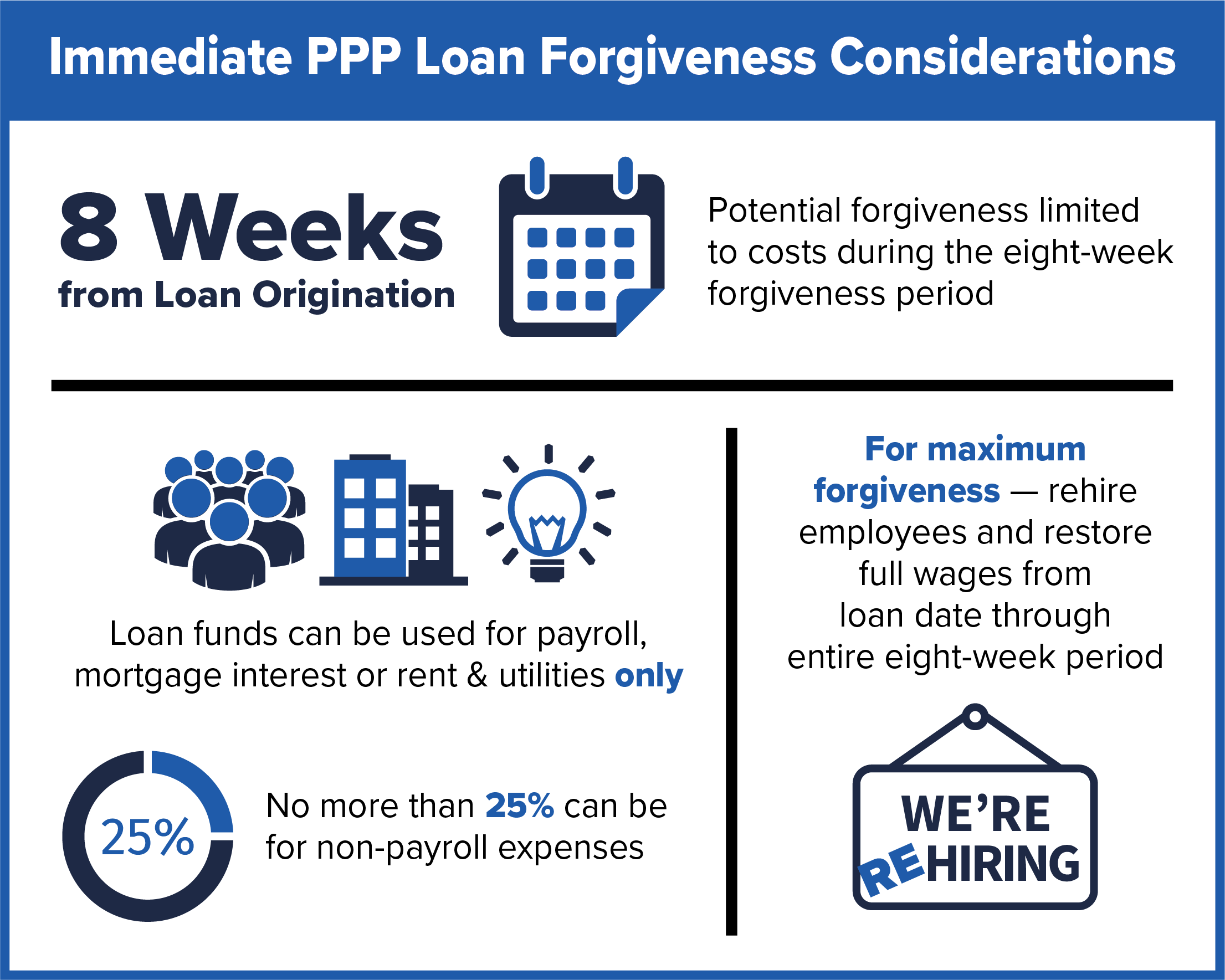

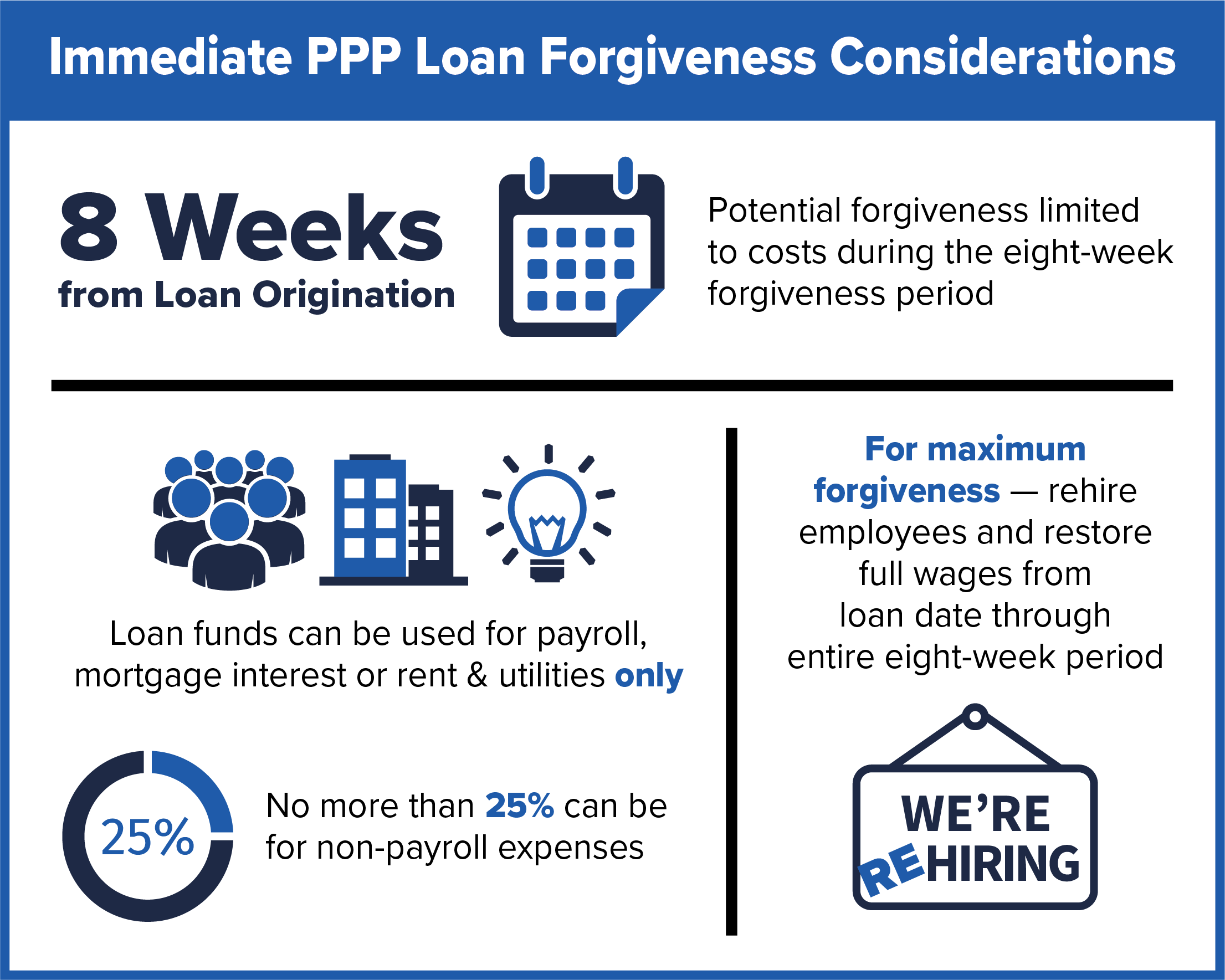

We believe applicants that submit complete, supported forgiveness information will receive the maximum amount of forgiveness possible and have their forgiveness processed quickly.

We believe applicants that submit complete, supported forgiveness information will receive the maximum amount of forgiveness possible and have their forgiveness processed quickly.