What is Private Equity?

Private Equity is an asset class – considered an “alternative asset” in typical nomenclature. Just like stocks, bonds, commodities, and real estate, eligible individuals can invest in private equity funds. Unlike these other assets, however, only a limited type of investors known as “accredited investors” (which has net worth or annual income requirements) can invest in private equity funds. US regulators have limited invest-ability in this asset class because of the illiquid nature of the investment.

In a typical situation, investors commit a certain amount of capital for a period of time, such as 10 years. During this time, there is usually little to no access to that capital. Some exceptions are gaining popularity (i.e., LP stakes transactions), but private equity investments are, on the whole, illiquid. Private equity returns have exceeded all other asset classes, sometimes substantially, returning upwards of $4 for every $1 committed to the private equity fund.

What does Private Equity have to do with physician practices?

For decades now, private equity has been interested in investing in physician practices. At risk of simplification, the thesis centers around economies of scale. These investors believe that a large, well-funded physician practice is able to capitalize on efficiencies with back-office support, substantial improvement in revenue cycle, care coordination resources, service line expansion and cross-referral opportunities, resource dedication to recruitment, structured paths to partnership, etc. Consolidation of providers is also seen as a natural response to the consolidation that has taken place in the payer ecosystem, in hopes to create better opportunities to partner with payers on win-win strategies. Private equity-backed physician practices have also generated substantial returns for private equity sponsors and partner physicians in the past. Hence, private equity remains interested in physician practices broadly.

Certain specialties (such as dermatology and ophthalmology) have been favored in the past, while other specialties (such as risk-based primary care and cardiology) have gained favor in more recent years. To generalize, private equity backed practices are able to achieve rapid growth inorganically, that is, through acquiring independent physician practices. However, there has been a notable shift in organic growth efforts with increased interest rates and macroeconomic uncertainty in the financial markets.

Do Private Equity Groups pay more for physician practices than hospitals?

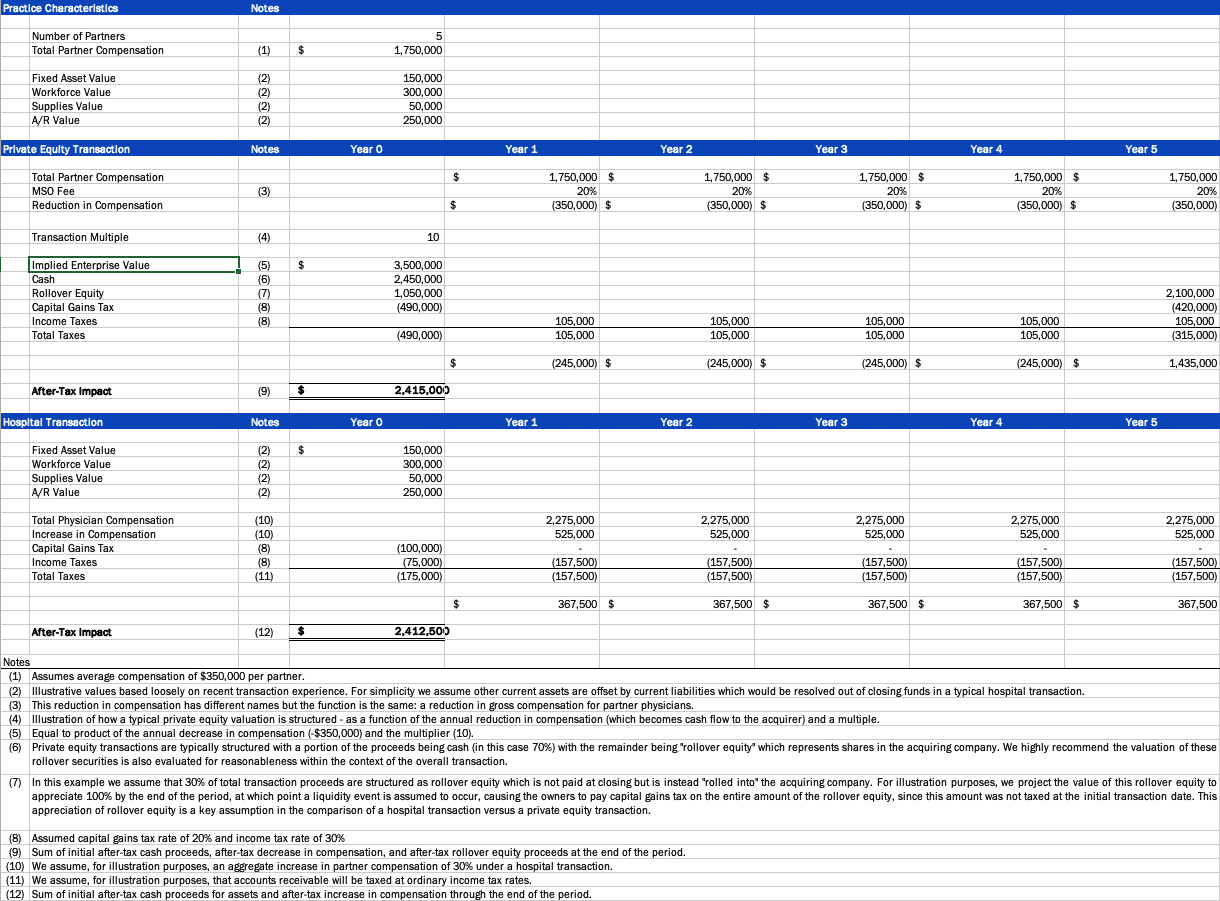

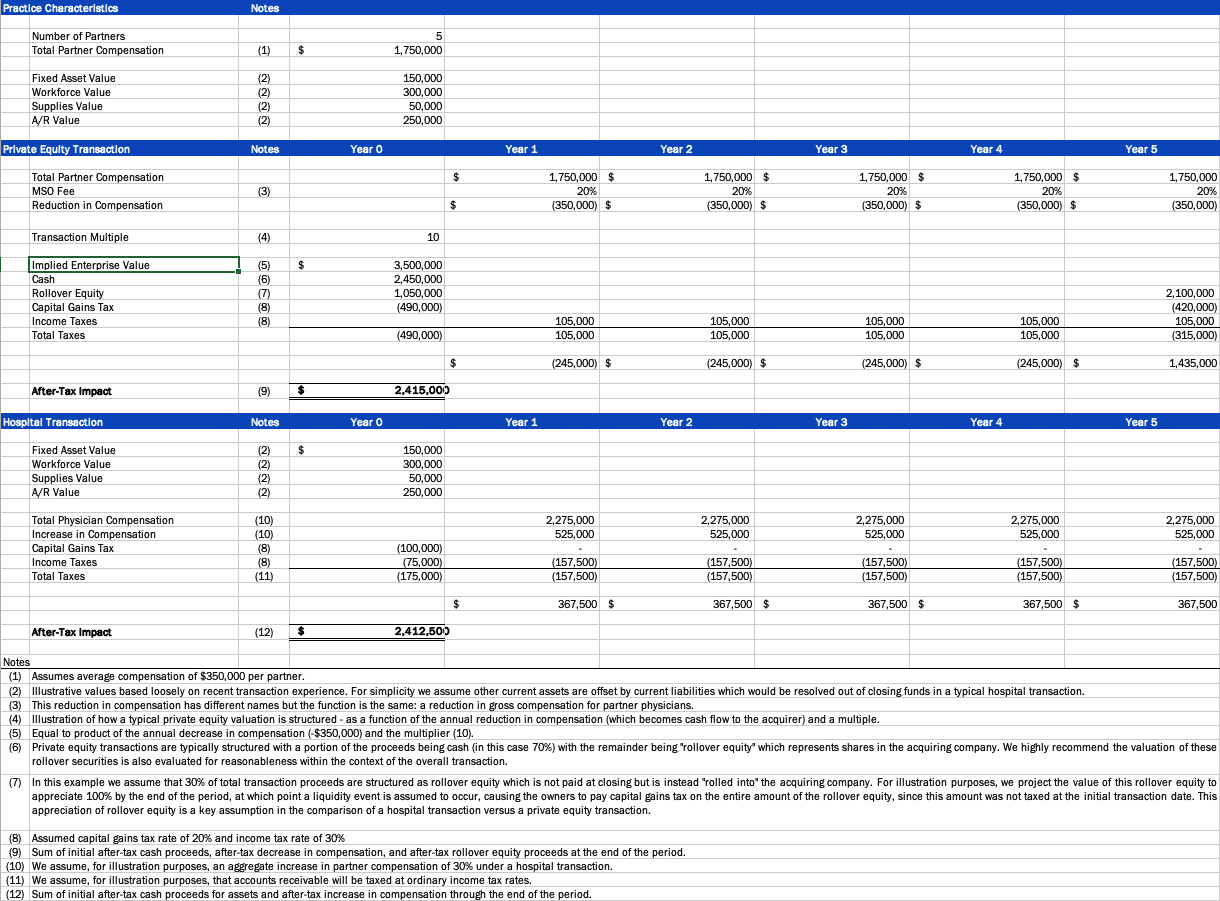

Not necessarily. While it is true that private equity groups typically offer much more up-front to acquire a practice, the reality is more complicated when you consider the after-tax effects of the transaction on compensation and other factors. In our experience, a transaction involving private equity most often involves some sort of decrease in owner compensation for some period of time. This decrease in compensation has many names and can take several different forms, but the impact is similar – owner physicians receive a (sometimes) significant value for the practice up-front in connection with a decrease in compensation going forward.

When you factor in the up-front purchase price along with the decrease in compensation for a period of time, on an after-tax basis, a private equity transaction might be quite similar to a hospital transaction, even though the two approach the valuation of the practice from polar opposite viewpoints. Indeed, in our experience, a hospital transaction typically involves a purchase of certain identified assets of the practice (such as furniture, fixtures, and equipment, workforce-in-place, and drugs & medical supplies), which can be fairly insignificant compared to a private equity offer. However, in hospital transactions, our experience has been that owner physicians typically notice an increase in compensation going forward – which might even be guaranteed for a period of time.

There may also be signing bonuses and other considerations to entice physicians to sell to a hospital. Nonetheless, it is important to consider the impacts on an after-tax basis, as aspects of a typical private equity sale are taxed more advantageously at capital gains rates (or in some cases not taxed at all) compared to an increase in compensation which is taxed at ordinary income rates. As the example shows, based on some simplifications for the sake of argument, it is possible that a hospital offer is quite similar to a private equity offer.

The difference in the way that private equity approaches a transaction compared to a hospital is driven partially by the regulatory landscapes that these potential buyers operate in. While it is true that private equity groups may not be subject to the same regulations as hospitals, they have their own regulations to adhere to, sometimes involving conflicting laws in multiple states. Thus, the way that private equity groups and hospitals each place a value on the transactions involved in a physician practice sale end up looking very different.

What is “rollover equity” and what does it mean for me?

One of the biggest financial decision factors between choosing a hospital offer and a private equity offer from a financial viewpoint is the so-called “rollover equity” consideration. Rollover equity represents ownership in the company that is acquiring the practice. So, while the owner physicians may be selling the practice that they founded, they are becoming owners alongside other selling physicians within the larger organization.

We have seen a significant amount of total private equity offers allocated to rollover equity. This means that, over time, a smaller component of the private equity offer is paid out in cash and taxed on the closing date.

As the amount of rollover equity increases, it becomes paramount that the rollover equity component of the transaction be properly evaluated for reasonableness. This is because the rollover equity is typically awarded as a number of shares rather than a nominal amount. For example, assume that $1,000,000 of a transaction is allocated to rollover equity. The private equity group will award the selling physician 100,000 shares assuming a value of $10 per share.

There is no way of knowing if that is in fact a good deal for the physician without turning the tables and performing a valuation (of sorts) of the potential buyer. Thus, a transaction involving rollover equity involves two valuations: one for the selling group and one for the rollover equity in the acquiring entity.

The risk/return profile of rollover equity is one of the largest unknowns for a private equity transaction. It is not uncommon for rollover equity to more than double in a short period if all goes well. This can sometimes tip the scales in favor of a private equity transaction as opposed to a hospital transaction. However, it is also true that the rollover equity may be devalued as time goes on if the organization doesn’t meet certain milestones (most or all of which are in the hands of management).

Conclusion

Hospitals and private equity groups seem to approach investment in physician practices from opposite directions. Private equity tends to offer higher up-front purchase consideration with an expectation of lower compensation going forward while hospitals typically take an inverse approach. This is further complicated by differential tax treatment under each scenario as well as estimating the intrinsic value of the rollover equity along with its potential future worth. While difficult, it is possible to compare different offers on an after-tax basis to make more informed decisions. Therefore, careful consideration must be given to each aspect of transaction deliberations.

Author: Jarrod Barraza

Download an overview of PE vs Hospital Schedules