Over the past year, business owners have been confronted with key decision points related to uncertainty about the COVID-19 pandemic and how to be competitive in the new economic environment. Prices are increasing, consumer spending is up, and customer behaviors have shifted more dramatically in the past year than in recent history.

Amidst the macroeconomic changes taking place, political and policy decisions are equally important in an owner’s calculus, most notably, the potential capital gains tax increases that have been proposed to take effect in 2022. As a result, the M&A market has heated up, and many owners are determining whether it may be more advantageous to sell this year than to wait.

Is Now the Time to Sell?

For lower- and middle-market businesses, companies in many industries are proving valuations and exit multiples at near all-time highs. The amount of capital that buyers have to deploy has grown significantly. Competition for profitable businesses is high, and sellers who engage in a sell-side process are positioned to retain more leverage.

Potential sellers on the fence about whether now is the time to sell should keep in mind both the favorable environment and the length of time that a sell-side process can take.

A Six-Month-Plus Process

Owners have a number of options when selling their businesses, and the optimal strategy is driven by specific seller circumstances. The most effective method for retaining leverage and controlling the timeline is a sell-side marketing process. Whether broad, limited or targeted, running a modified auction to sell a business successfully can last anywhere from six to nine months.

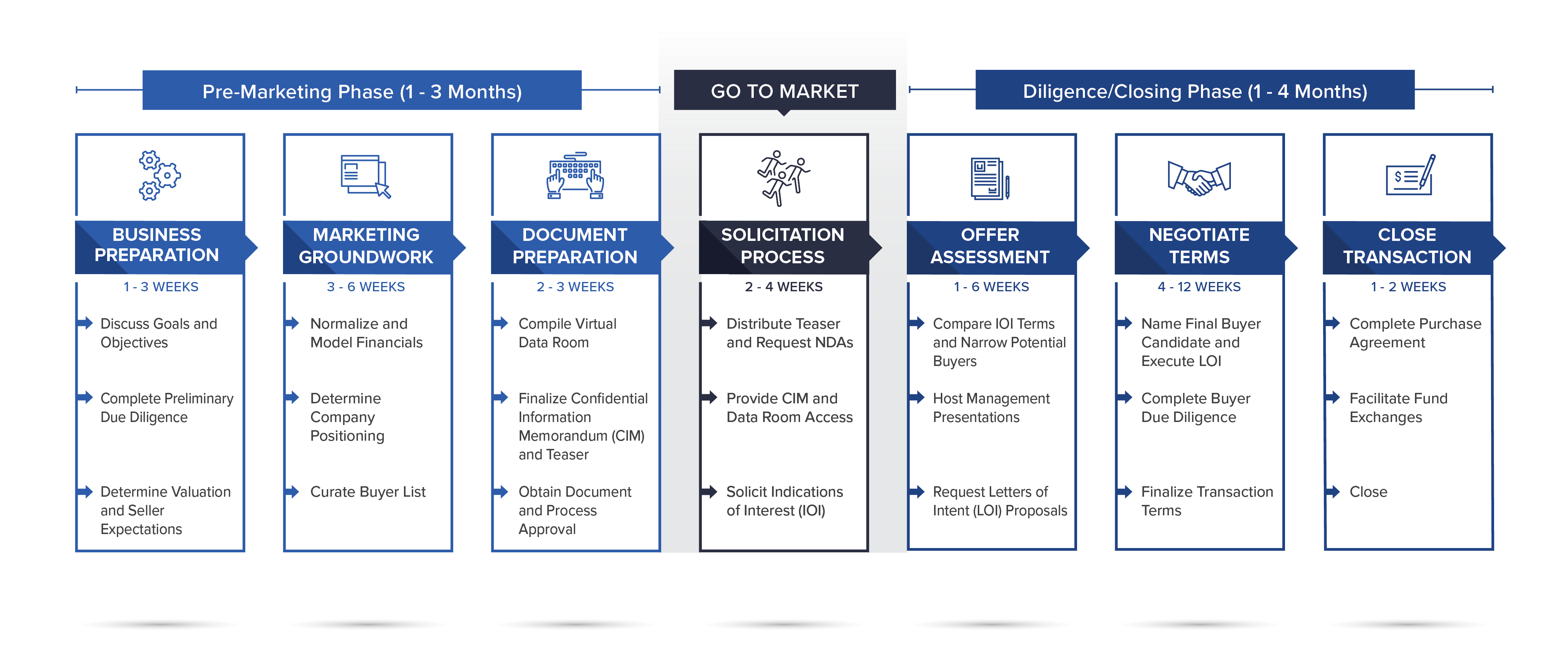

The graphic below highlights the steps involved and many of the key actions that a sell-side adviser like HORNE Capital will take to market a business.

Beginning with the Pre-Marketing Phase, an adviser will prepare and develop financials and marketing documents to solicit offers from a procured buyer list when it is time to Go to Market. Then, the Diligence and Closing Phase involves several key steps, each of which is designed to bring additional value to sellers and prepare both parties for integration upon closing.

Before negotiations begin and after a final buyer is selected, the appropriate steps can take much longer than many sellers initially anticipate.

Start Now

The bottom line is that owners who are considering exiting or transitioning their businesses within the next few years are well-positioned to take advantage of this strong seller’s market and avoid the risk of paying more in taxes in the future.

Given the six-month-plus selling timeline for effectively exiting a business, those who wish to sell in 2021 should take action now. The sell-side process can be expedited; however, what is often a once-in-a-lifetime event for owners — selling their businesses — is not one that founders and entrepreneurs prefer to rush. Sell-side advisers like HORNE Capital can help sellers earn additional value and terms by thoroughly navigating each step of the process.

HORNE Capital is a FINRA-licensed, Mississippi-based investment banking firm that offers financial advice on divestitures, mergers and acquisitions, and valuations for lower-to-middle-market companies. For more information or to discuss the opportunity to sell your business, visit www.hornecapital.com or email Neal Stephens at [email protected].