We’re dedicated to seeing our clients and our world thrive.

In moments of rapid change, few companies feel prepared for the risks and disruption caused by technology, regulations, talent shortages and competition. As a top 30 professional services firm, we are decidedly different – going beyond traditional services and steering clients through uncertainty and opportunity.

Business

exit planning

Cybersecurity

Economic

Recovery

intelligence &

automation

Mergers &

acquisitions

people

solutions

strategic

consulting

wealth building

strategies

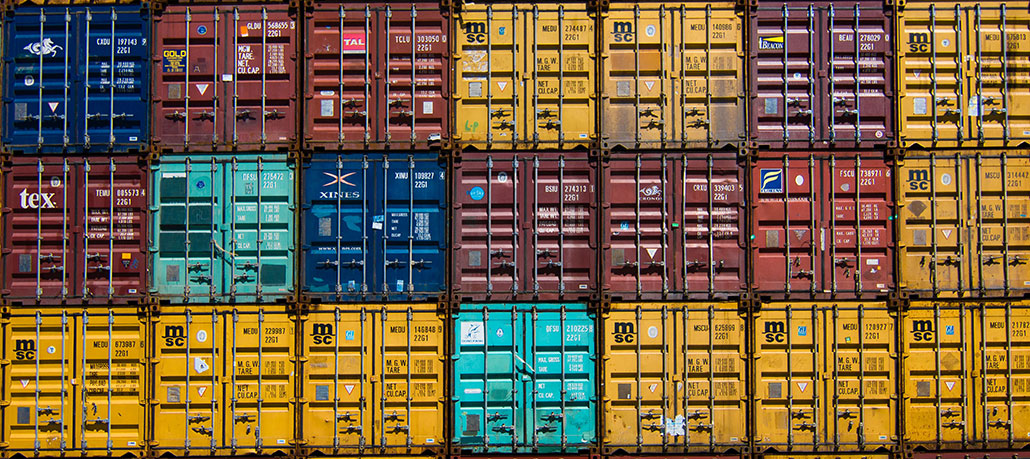

Industry-spanning expertise for today’s opportunities and challenges

INDUSTRY OVERVIEW

CONSTRUCTION

HORNE Construction goes beyond traditional accounting, bringing innovative solutions and strategic insights to tackle your company’s most pressing challenges. Our team combines deep industry expertise with a proactive approach to minimize risk, drive growth, and help you achieve long-term success.

INDUSTRY OVERVIEW

FINANCIAL INSTITUTIONS

Securing the growth and sustainability of your organization takes a strong partner who proactively brings new ideas and fresh perspectives. Based on years of serving financial institutions through good times and crises, we provide diverse perspectives, useful answers and strategies for increased operational efficiency and growth.

INDUSTRY OVERVIEW

FRANCHISE

HORNE offers a range of outsourced accounting, financial operation consulting and business strategy solutions that free you to focus on high-value opportunities like driving growth and customer experience. Let us tailor a plan to fit your needs.

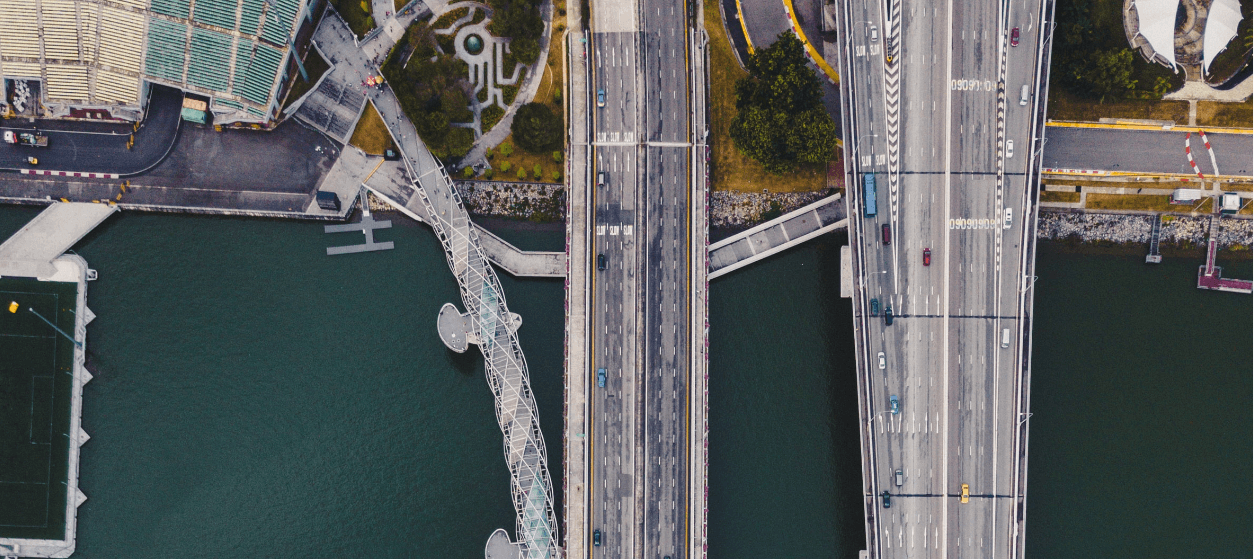

INDUSTRY OVERVIEW

GOVERNMENT

With a long history of service in crisis situations, we can help your community recover from natural disasters and pandemics faster and better than anyone thought possible.

INDUSTRY OVERVIEW

HEALTHCARE

In these challenging times, healthcare professionals must do more with less, all while facing increased competition and regulations. To succeed, you must anticipate and solve problems before they occur. HORNE Healthcare provides a reliable resource for the insights you need for success today and tomorrow.

INDUSTRY OVERVIEW

PRIVATELY HELD COMPANIES

As privately held companies grow, the opportunities increase — and so do the complexities. At HORNE, we help you navigate the business, financial, tax, technical and personnel issues that rise along the way so that you can focus on growing your business and achieving your goals.

INDUSTRY OVERVIEW

PUBLICLY TRADED COMPANIES

From increasing regulations to sophisticated cyber threats, today’s public companies face an overwhelming array of challenges, such as increasing regulations and sophisticated cyber threats. HORNE provides the tax, audit and accounting insights required to mitigate risk, plus the consulting services you need to create true competitive advantage.

Insight & perspective

for your world

Understanding Nexus: Potential Tax Implications of Working Across State Lines

Expanding your contracting business into new states can open exciting growth opportunities, but it can also bring unexpected tax obligations.

READ MORE

A steadfast commitment to our team members.

Culture matters. At HORNE, 91% of our team members say that HORNE is a great workplace.

Emotional Intelligence for Project Success

Emotional intelligence in construction helps project managers lead with clarity, improve outcomes, and build stronger teams. Here’s how to grow EQ today.

READ MORE

The House of Medicaid Rests on Five Pillars: Benefits

Medicaid is the largest single source of coverage for paid long-term services and supports (LTSS) in the U.S. According to CBO, the federal share of payments for institutional care, primarily nursing facilities, will be $73 billion in 2030.

READ MORE

Read more of our latest insights.

Careers built for impact, because it’s more than just a job.

You take your career seriously. If you’re passionate about where you’re going, we’ll give you the tools, resources and relationships you need to get there.